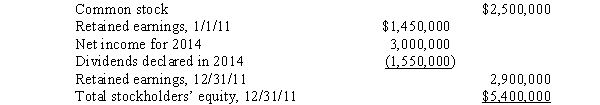

The following balances were taken from the records of S Company:

P Company owns 80% of the common stock of S Company.During 2014, P Company purchased merchandise from S Company for $4,000,000.S Company sells merchandise to P Company at cost plus 25% of cost.On December 31, 2014, merchandise purchased from S Company for $1,250,000 remains in the inventory of P Company.On January 1, 2014, P Company's inventory contained merchandise purchased from S Company for $525,000.The affiliated companies file a consolidated income tax return.There was no difference between the implied value and the book value of net assets acquired.

Required:

A.Prepare all workpaper entries necessitated by the intercompany sales of merchandise.

B.Compute noncontrolling interest in consolidated income for 2014.

C.Compute noncontrolling interest in consolidated net assets on December 31, 2014.

Correct Answer:

Verified

(2) .2($105,000)

B....

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: On January 1, 2014, Pharma Company

Q25: Are the adjustments to the noncontrolling interest

Q26: Does the elimination of the effects of

Q27: Puma Company owns 80% of the common

Q28: Use the following information for Questions 22

Q30: P Company sells inventory costing $100,000 to

Q31: Poole Company owns a 90% interest in

Q32: Determination of the noncontrolling interest in consolidated

Q33: Use the following information for Questions 22

Q34: Why are adjustments made to the calculation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents