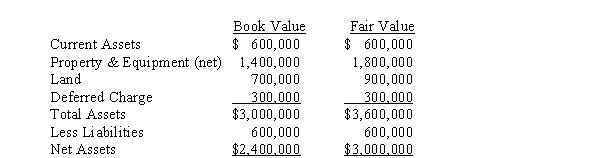

Plain Corporation acquired a 75% interest in Swampy Company on January 1, 2013, for $2,000,000.The book value and fair value of the assets and liabilities of Swampy Company on that date were as follows:

The property and equipment had a remaining life of 6 years on January 1, 2013, and the deferred charge was being amortized over a period of 5 years from that date.Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2013.Plain Company records its investment in Swampy Company using the cost method.

Required:

Prepare, in general journal form, the December 31, 2013, workpaper entries necessary to:

A.Eliminate the investment account.

B.Allocate and amortize the difference between implied and book value.

Correct Answer:

Verified

Q25: Pruin Corporation acquired all of the voting

Q26: The parent company's share of the fair

Q27: Pennington Corporation purchased 80% of the voting

Q28: Pullman Corporation acquired a 90% interest in

Q29: On January 1, 2013, Preston Corporation acquired

Q31: How do you determine the amount of

Q32: On January 1, 2013, Pilsner Company

Q33: Pulman Company acquired 90% of the stock

Q34: What are the arguments for and against

Q35: Phillips Company purchased a 90% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents