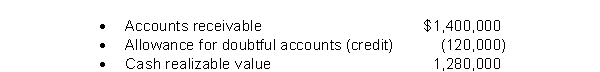

The following information is related to December 31, 2016 balances.  During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. The change in the cash realizable value from the balance at 12/31/16 to 12/31/17 was

During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. The change in the cash realizable value from the balance at 12/31/16 to 12/31/17 was

A) 136,000 increase.

B) $160,000 increase.

C) $114,000 increase.

D) $138,000 increase.

Correct Answer:

Verified

Q92: The direct write-off method of accounting for

Q95: Under the direct write-off method of accounting

Q135: The direct write-off method is acceptable for

Q136: The following information is related to

Q138: The bookkeeper recorded the following journal entry

Q139: When calculating interest on a promissory note

Q145: Rosen Company receives a $9,000, 3-month, 6%

Q146: When a company receives an interest-bearing note

Q148: Ramos Company has a 90-day note that

Q159: The interest on a $20,000, 6%, 60-day

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents