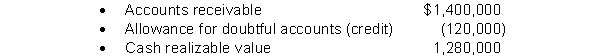

The following information is related to December 31, 2016 balances.  During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. Bad debt expense for 2017 is:

During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. Bad debt expense for 2017 is:

A) $46,000.

B) $24,000.

C) $144,000.

D) $ 2,000.

Correct Answer:

Verified

Q96: When an account is written off using

Q117: Using the percentage-of-receivables method for recording bad

Q119: Using the percentage-of-receivables method for recording bad

Q119: You have just received notice that a

Q120: Using the allowance method, the uncollectible accounts

Q122: During 2017 Sedgewick Inc. had sales on

Q123: An analysis and aging of the accounts

Q124: A company has an ending accounts receivable

Q125: The following information is related to

Q126: Thompson Corporation's unadjusted trial balance includes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents