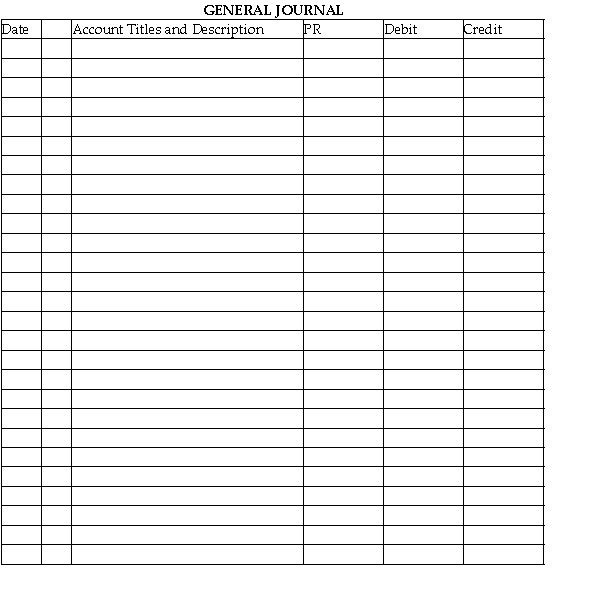

Plymouth Sharks Hockey Accessories had the following transactions involving the sale of merchandise.You are to prepare the necessary general journal entries.All sales are subject to a 6% sales tax and have a 2/10,n/30 discount terms.

December 2 Sold merchandise priced at to Cathy Norton on account.

December 4 Sold merchandise priced at to a cash customer.

Decem ber 10 Payment from Cathy Norton received.

Decem ber 16 Cash customer returned worth of merchandise.

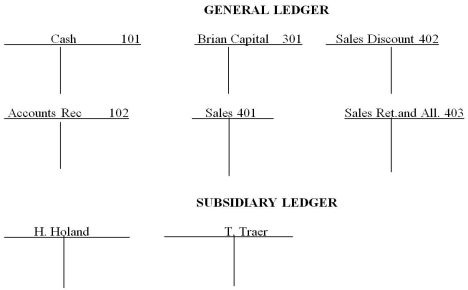

-The following are transactions for Brian for the month of October.Indicate how the following transactions would be recorded by completing the necessary journal entries as appropriate (omit explanations).Also post to the subsidiary general and subsidiary ledgers.

Oct.1 Brian invested $15,000 in his business.

Oct.3 Sold $2,500 of merchandise on account to H.Holand,sales invoice No.1,terms 1/10,n/30.

Oct.5 Sold $1,200 of merchandise on account to T.Traer,sales invoice No.2,terms 1/10,n/30.

Oct.13 Received cash from H.Holand in payment for October 3 transaction,less the discount.

Oct.14 Issued credit memorandum No.1 to T.Traer for $100 for merchandise returned from October 5 sale on account.

Oct.15 Received cash from T.Traer for the amount due,less the discount.

Correct Answer:

Verified

Q105: The Milk Co. had the following transactions

Q106: The Bay Co. had the following transactions

Q115: The Bay Co. had the following transactions

Q115: Determine the amount to be paid within

Q116: Determine the amount of cash collected at

Q120: Sue's Jewelry sold 30 necklaces for $25

Q121: The Milk Co. had the following transactions

Q122: The Milk Co. had the following transactions

Q123: The Milk Co. had the following transactions

Q124: The Milk Co. had the following transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents