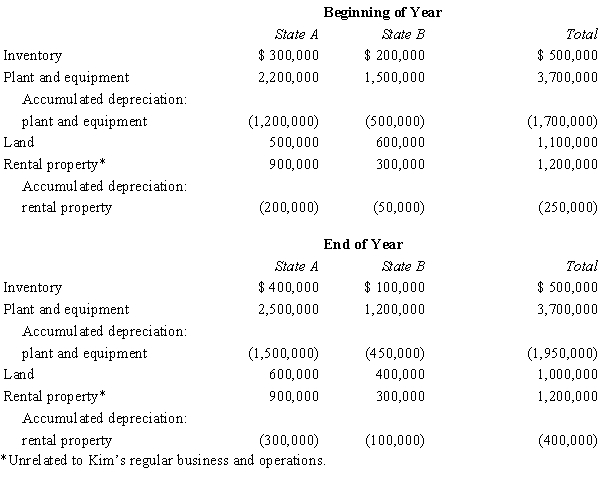

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kim's property holdings follows.  Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: Match each of the following terms with

Q131: Determine Drieser's sales factors for States

Q132: Condor Corporation generated $450,000 of state

Q134: Milt Corporation owns and operates two

Q134: A state might levy a(n) tax when

Q135: Garcia Corporation is subject to tax

Q135: The sale of groceries to an individual

Q137: Flip Corporation operates in two states,

Q139: Compute Still Corporation's State Q taxable

Q147: Troy,an S corporation,is subject to tax only

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents