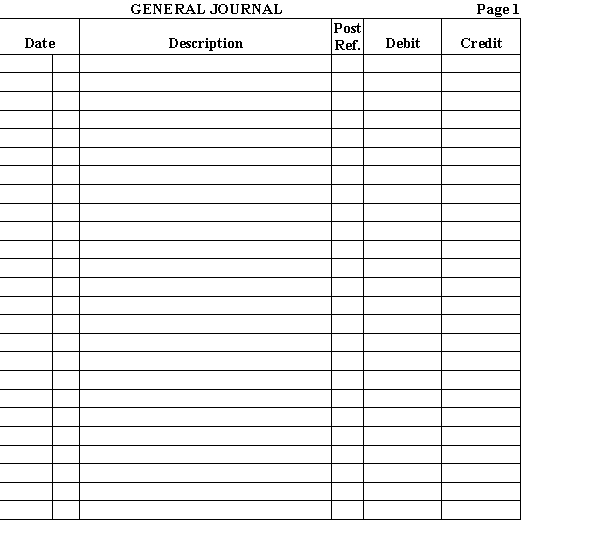

Prepare journal entries for the following transactions for Sanchez Co. using the general journal.

Feb. 28

Machinery that cost $57,000 and had accumulated depreciation of $46,000 was sold for $2,500.

Apr. 10

A van that cost $23,700 and had accumulated depreciation of $21,000 was sold for $1,250.

July 16

Equipment that cost $120,000 and had accumulated depreciation of $112,000 was traded in for new equipment with a fair market value of $140,000. The old equipment and $135,000 in cash were given for the new equipment.

Aug. 11

Equipment that cost $50,000 and had accumulated depreciation of $43,000 was traded in for new equipment with a fair market value of $62,000. The old equipment and $55,000 in cash were given for the new equipment.

Nov. 10

A truck that cost $44,000 and had accumulated depreciation of $38,000 was traded in for a new truck with a fair market value of $58,000. The old truck and $50,000 cash were given for the new truck.

Correct Answer:

Verified

Q62: A printer that cost $600 and has

Q63: Prepare journal entries for the following transactions

Q64: A farm tractor costing $80,000 is depreciated

Q65: A coal mine was acquired at a

Q66: The accounting entry for additions and improvements

Q68: Under the Modified Accelerated Cost Recovery System

Q69: An asset is purchased on January 1

Q70: An asset is purchased on January 1

Q71: A company purchased a van at a

Q72: A manufacturer or seller of a product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents