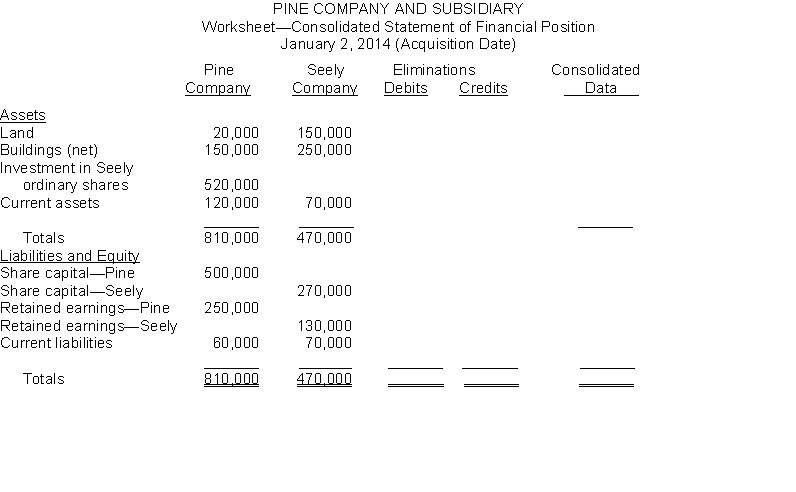

*On January 2, 2014, Pine Company purchased 100% of the outstanding common shares of Seely Company for $520,000. Any excess of cost over the book value of the net assets of Seely company should first be allocated to land $55,000, and Buildings $40,000 and any remainder to Goodwill.

Instructions

(a) Complete the following worksheet below for preparing a consolidated statement of financial position on the date of acquisition. You may add accounts to the worksheet that may be necessary.

(b) Prepare a consolidated statement of financial position Afor Pine Company and Subsidiary on January 2, 2014.

Correct Answer:

Verified

Q163: Cost of debt investments includes the price

Q174: Debt investments are investments in government and

Q178: Fair Value Adjustment is a valuation _

Q206: A consolidated statement of financial position reports

Q207: Short-term investments are securities that are _

Q208: Distinguish between the cost and equity methods

Q210: At the end of an accounting period,

Q213: _ securities are held with the intent

Q214: At the beginning of the year, Grant

Q220: An unrealized gain or loss on non-trading

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents