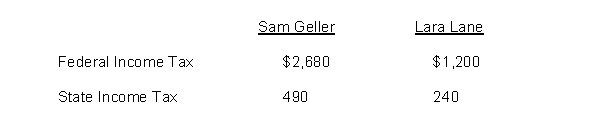

Sam Geller had earned (accumulated) salary of $99,000 through November 30. His December salary amounted to $9,000. Lara Lane began employment on December 1 and will be paid her first month's salary of $6,000 on December 31. Income tax withholding for December for each employee is as follows:  The following payroll tax rates are applicable:

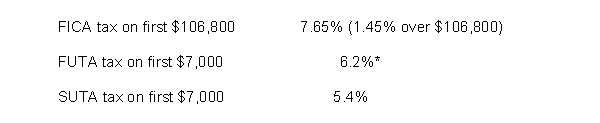

The following payroll tax rates are applicable:  *Less a credit equal to the state unemployment contribution

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Correct Answer:

Verified

Q10: With a financial calculator one can solve

Q14: The decision to make long-term capital investments

Q19: Many companies calculate the future value of

Q123: By January 31 following the end of

Q124: The journal entry to record the payroll

Q135: FICA taxes do not provide workers with

A)

Q154: The tax that is paid equally by

Q155: The effective federal unemployment tax rate is

Q161: If $40,000 is deposited in a savings

Q205: An employee's net pay consists of gross

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents