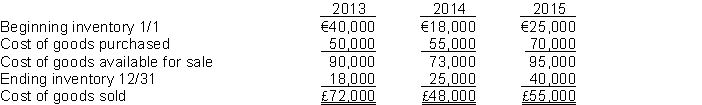

Speer's Hardware Store prepared the following analysis of cost of goods sold for the previous three years:  Net income for the years 2013, 2014, and 2015 was €70,000, €60,000, and €65,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

Net income for the years 2013, 2014, and 2015 was €70,000, €60,000, and €65,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

The accountant determined the following:

1. Purchases of €20,000 were not recorded in 2013.

2. The 2013 December 31 inventory should have been €21,000.

3. The 2014 ending inventory included inventory costing €8,000 that was purchased FOB destination and in transit at year end.

4. The 2015 ending inventory did not include goods costing €4,000 that were shipped on December 29 to Sampson Plumbing Company, FOB shipping point. The goods were still in transit at the end of the year.

Instructions

Determine the correct net income for each year. (Show all computations.)

Correct Answer:

Verified

Q226: Boyer Company applied FIFO to its inventory

Q227: The following information is available for Witten

Q228: Compute the lower-of-cost-or-net realizable value valuation for

Q229: Zimmer Company uses the perpetual inventory system

Q230: Eckert Company reported the following summarized annual

Q232: The controller of Scheller Company is applying

Q233: Graves Pharmacy reported cost of goods sold

Q234: Finch Company is preparing the annual financial

Q235: Instructions

Using the inventory and sales data above,

Q236: Accounting for inventories is important because inventories

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents