Transaction and adjustment data for Alcortt Company for the calendar year end is as follows:

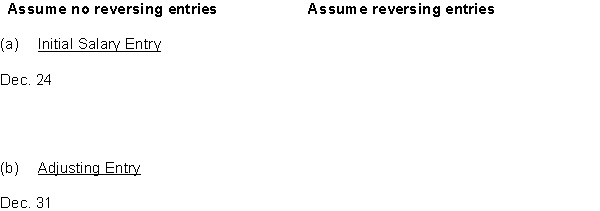

1. December 24 (initial salary entry): ₤18,000 of salaries and wages earned between December 1 and December 24 are paid.

2. December 31 (adjusting entry): Salaries and wages earned between December 25 and December 31 are ₤3,000. These will be paid in the January 8 payroll.

3. January 8 (subsequent salary entry): Total salary payroll amounting to ₤11,000 was paid.

Instructions

Prepare two sets of journal entries as specified below. The first set of journal entries should assume that the company does not use reversing entries, and the second set should assume that reversing entries are utilized by the company.

(

Correct Answer:

Verified

Q203: The account balances appearing in the adjusted

Q215: The process of transferring net income (or

Q223: Compute the dollar amount of current assets

Q224: Indicate the proper sequence of the steps

Q225: Harken Company discovered the following errors made

Q229: Identify which of the following accounts would

Q230: On December 31, 2013 the adjusted trial

Q231: The financial statement columns of the worksheet

Q232: The following account balances appeared in the

Q233: The financial statement columns of the worksheet

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents