On March 1, Year 1, Chase Inc. purchases 35% of the outstanding shares of Glory Corporation stock for $325,000. On December 31, Year 1, Glory reports net income of $162,000. On January 15, Year 2, Glory pays total dividends to stockholders of $33,000.

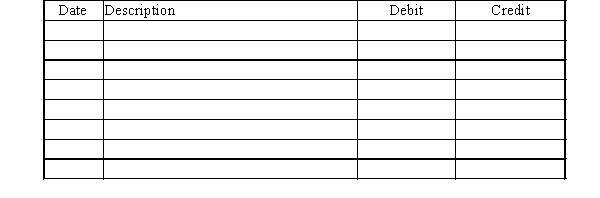

Journalize the three transactions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: On January 1, the Valuation Allowance for

Q104: On January 1, the Valuation Allowance for

Q123: Following is data for the available-for-sale securities

Q123: On February 12, Addison, Inc. purchased 6,000

Q124: Skyline, Inc. purchased a portfolio of trading

Q124: Prepare the journal entries for the following

Q128: Skyline, Inc. purchased a portfolio of available-for-sale

Q129: During the first year of operations,

Q151: Sutton Company purchased 10% of the outstanding

Q153: Discuss the appropriate financial treatment when an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents