Use the following information for questions 44 and 45.

Dream Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2015. In 2015, it changed to the percentage-of-completion method.

The company decided to use the same for income tax purposes. The tax rate enacted is 40%.

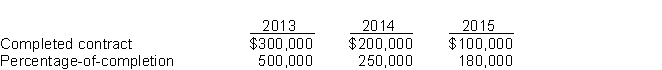

Income before taxes under both the methods for the past three years appears below.

-Which of the following will be included in the journal entry made by Dream Home to record the income effect?

A) A debit to Retained Earnings for $150,000

B) A credit to Retained Earnings for $150,000

C) A credit to Retained Earnings for $100,000

D) A debit to Retained Earnings for $100,000

Correct Answer:

Verified

Q40: A company changes from percentage-of-completion to completed-contract

Q41: On January 1, 2012, Piper Co., purchased

Q42: During 2015, a construction company changed from

Q43: Use the following information for questions 57

Q44: Use the following information for questions 44

Q46: Use the following information for questions 53

Q47: Use the following information for questions 47

Q48: Equipment was purchased at the beginning of

Q49: On January 1, 2012, Knapp Corporation acquired

Q50: Heinz Company began operations on January 1,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents