Use the following information for questions 55 and 56.

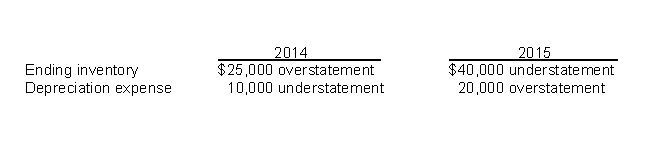

Armstrong Inc. is a calendar-year corporation. Its financial statements for the years ended 12/31/14 and 12/31/15 contained the following errors:

-Assume that the 2014 errors were not corrected and that no errors occurred in 2013. By what amount will 2014 income before income taxes be overstated or understated?

A) $35,000 overstatement

B) $15,000 overstatement

C) $35,000 understatement

D) $15,000 understatement

Correct Answer:

Verified

Q55: On January 1, 2012, Neal Corporation acquired

Q56: Lanier Company began operations on January 1,

Q57: Accrued salaries payable of $51,000 were not

Q58: Use the following information for questions 53

Q59: Use the following information for questions 57

Q61: Use the following information for questions 66

Q62: On January 1, 2015, Frost Corp. changed

Q63: On January 1, 2012, Hess Co. purchased

Q64: Use the following information for questions 64

Q65: On December 31, 2015, Grantham, Inc. appropriately

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents