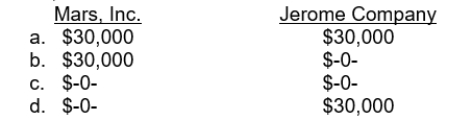

Mars, Inc. follows IFRS for its external financial reporting, while Jerome Company uses U.S. GAAP for its external financial reporting. During the year ended December 31, 2015, both companies changed from using the completed-contract method of revenue recognition for long-term construction contracts to the percentage-of-completion method. Both companies experienced an indirect effect, related to increased profit-sharing payments in 2015, of $30,000. As a result of this change, how much expense related to the profit-sharing payment must be recognized by each company on the income statement for the year ended December 31, 2015?

Correct Answer:

Verified

Q93: Ben, Inc. follows U.S. GAAP for its

Q94: Haystack, Inc. owns 30% of the outstanding

Q95: The controller for Haley Corporation is concerned

Q96: Is the following exception applicable to IFRS

Q97: Dyke Company's net incomes for the past

Q98: Under IFRS, the direct effects of changes

Q99: Under IFRS, errors in financial statements are

Q100: IFRS requires that any indirect effect of

Q101: Ridge, Inc. follows IFRS for its external

Q103: Mars, Inc. follows IFRS for its external

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents