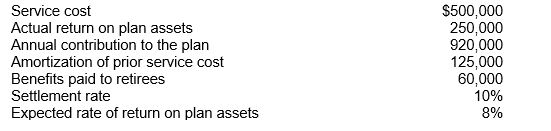

The accountant for Marlin Corporation has developed the following information for the company's defined-benefit pension plan for 2015:  The accumulated benefit obligation at December 31, 2015, amounted to $3,250,000.

The accumulated benefit obligation at December 31, 2015, amounted to $3,250,000.

Instructions

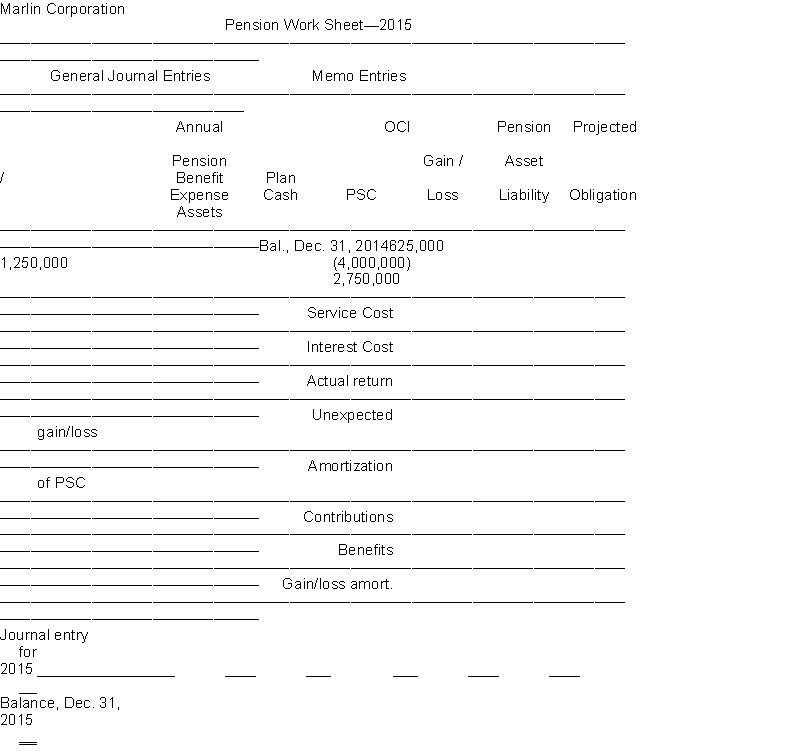

(a) Using the above information for Marlin Corporation, complete the pension work sheet for 2015. Indicate (credit) entries by parentheses. Calculated amounts should be supported.

(b) Prepare the journal entry to reflect the accounting for the company's pension plan for the year ending December 31, 2015.

Correct Answer:

Verified

Q116: Presented below is information related to

Q117: On January 1, 2015, McGee Co.

Q118: Discuss the following ideas related to pension

Q119: Kessler, Inc. received the following information from

Q120: Seigel Co. maintains a defined-benefit pension plan

Q122: Which of the following is true with

Q123: Under U.S. GAAP companies may either recognize

Q124: Prior service cost is recognized on the

Q125: Midland Company follows U.S. GAAP for its

Q126: The IASB and the FASB are studying

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents