Use the following information for questions 76-78.

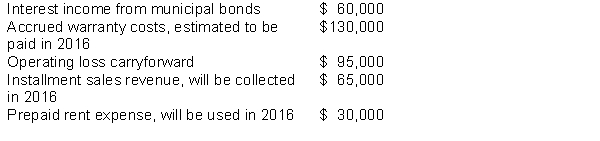

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

-The ending balance in Elephant, Inc's deferred tax liability at December 31, 2015 is

A) $23,000

B) $38,000

C) $26,000

D) $78,000

Correct Answer:

Verified

Q64: Eckert Corporation's partial income statement after its

Q65: Use the following information for questions 79

Q66: Watson Corporation prepared the following reconciliation for

Q67: Use the following information for questions 70

Q68: Ewing Company sells household furniture. Customers who

Q70: Ferguson Company has the following cumulative taxable

Q71: Cross Company reported the following results for

Q72: Horner Corporation has a deferred tax asset

Q73: Use the following information for questions 70

Q74: Use the following information for questions 76-78.

At

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents