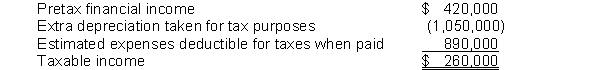

at the end of 2015, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  Use of the depreciable assets will result in taxable amounts of $350,000 in each of the next three years. The estimated litigation expenses of $890,000 will be deductible in 2018 when settlement is expected.

Use of the depreciable assets will result in taxable amounts of $350,000 in each of the next three years. The estimated litigation expenses of $890,000 will be deductible in 2018 when settlement is expected.

Instructions

(a) Prepare a schedule of future taxable and deductible amounts.

(b) Prepare the journal entry to record income tax expense, deferred taxes, and income taxes payable for 2015, assuming a tax rate of 40% for all years.

Correct Answer:

Verified

Q104: Under U.S. GAAP, the rate used to

Q105: For calendar year 2014, Kane Corp. reported

Q106: Farmer Inc. began business on January

Q107: In its 2014 income statement, Cohen Corp.

Q108: Listed below are items that are treated

Q110: Murphy Company purchased equipment for $300,000 on

Q111: Define temporary differences, future taxable amounts, and

Q112: at the end of 2015, its first

Q113: Dunn, Inc. uses the accrual method of

Q114: The following information is available for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents