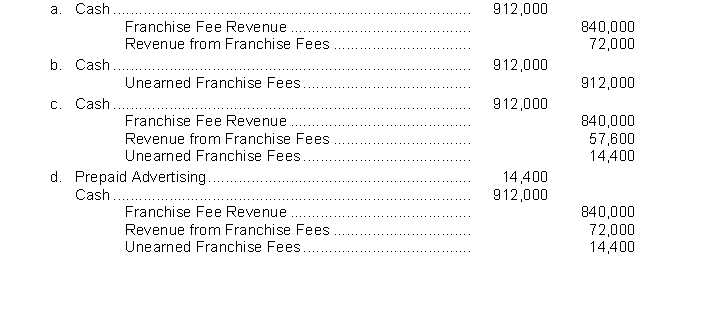

On January 1, 2015 Dairy Treats, Inc. entered into a franchise agreement with a company allowing the company to do business under Dairy Treats's name. Dairy Treats had performed substantially all required services by January 1, 2015, and the franchisee paid the initial franchise fee of $840,000 in full on that date. The franchise agreement specifies that the franchisee must pay a continuing franchise fee of $72,000 annually, of which 20% must be spent on advertising by Dairy Treats. What entry should Dairy Treats make on January 1, 2015 to record receipt of the initial franchise fee and the continuing franchise fee for 2015?

Correct Answer:

Verified

Q106: Braun, Inc. appropriately uses the installment-sales method

Q107: Wynne Inc. charges an initial franchise fee

Q108: Use the following information for questions 102

Q109: Use the following information for questions

Q110: Green Construction Co. has consistently used the

Q112: During 2014, Gates Corp. started a construction

Q113: Moon Co. records all sales using the

Q114: Bruner Constructors, Inc. has consistently used

Q115: Use the following information for questions 102

Q116: Use the following information for questions 99

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents