had $700,000 net income in 2015. On January 1, 2015 there were 200,000 shares of common stock outstanding. On April 1, 20,000 shares were issued and on September 1, Colson bought 30,000 shares of treasury stock. There are 30,000 options to buy common stock at $40 a share outstanding. The market price of the common stock averaged $50 during 2015. The tax rate is 40%.During 2015, there were 40,000 shares of convertible preferred stock outstanding. The preferred is $100 par, pays $3.50 a year dividend, and is convertible into three shares of common stock.Colson issued $2,000,000 of 8% convertible bonds at face value during 2014. Each $1,000 bond is convertible into 30 shares of common stock.

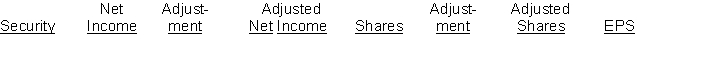

InstructionsCompute diluted earnings per share for 2015. Complete the schedule and show all computations.

Correct Answer:

Verified

Q150: Santana Corporation has 400,000 shares of common

Q151: Presented below is information related to Starr

Q152: Under IFRS, employee share-purchase plans must be

Q153: Use the following information for questions 12

Q154: Under IFRS recording for the issuance of

Q155: Under IFRS, convertible bonds are "bifurcated" -separated

Q156: With regard to recognizing stock-based compensation

A) IFRS

Q157: Dunbar Company had 500,000 shares of common

Q159: When $5,000,000 in convertible bonds are issued

Q160: Use the following information for questions 12

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents