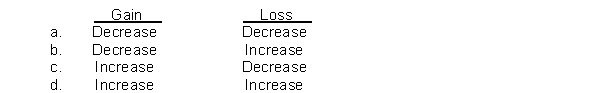

A plant asset with a five-year estimated useful life and no residual value is sold at the end of the second year of its useful life. How would using the sum-of-the-years'-digits method of depreciation instead of the double-declining balance method of depreciation affect a gain or loss on the sale of the plant asset?

Correct Answer:

Verified

Q129: True or False.

Place T or F in

Q130: Galt Company acquired a tract of land

Q131: Adjustment of Depreciable Base.A truck was acquired

Q132: Calculate depreciation.

A machine which cost $300,000

Q133: As with U.S. GAAP, IFRS requires that

Q135: In January 2014, Fritz Mining Corporation purchased

Q136: Impairment.

Presented below is information related to equipment

Q137: IFRS, like U.S. GAAP, capitalizes all direct

Q138: Composite depreciation.

Callon Co. uses the composite method

Q139: Even though IFRS does not employ the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents