A company receives interest on a $70,000, 8%, 5-year note receivable each April 1. At December 31, 2014, the following adjusting entry was made to accrue interest receivable:

Interest Receivable 4,200

Interest Revenue 4,200

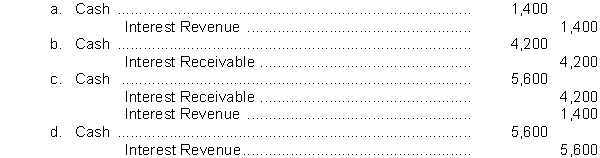

Assuming that the company does use reversing entries, what entry should be made on April 1, 2015 when the annual interest payment is received?

Correct Answer:

Verified

Q93: A company receives interest on a $70,000,

Q94: Brown Company's account balances at December 31,

Q95: Panda Corporation paid cash of $60,000 on

Q96: Adjusting entries that should be reversed include

Q97: Adjusting entries that should be reversed include

A)

Q99: Reversing entries are

1. normally prepared for prepaid,

Q100: Pappy Corporation received cash of $24,000 on

Q101: The income statement of Dolan Corporation for

Q102: Olsen Company paid or collected during 2014

Q103: Compared to the accrual basis of accounting,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents