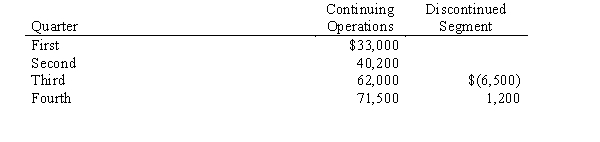

East Company, a highly diversified corporation, reports the results of operations quarterly. At the beginning of the third quarter, management decided to discontinue its recreational division. At this time, a formal plan was authorized, calling for disposal by year end. Results for the current year, excluding taxes, are as follows:

The following additional information was provided:

a.The first two quarters include results of operations of the discontinued segment. The segment reported first and second quarter pretax losses of $8,000 and $12,000, respectively.

b.The estimated annual income tax rate in the first and second quarters was 35%. Because of the decision to discontinue, the revised annual effective tax rate was determined to be 40%.Required:For each quarter, present the results of operations and the related tax expense or tax benefit. Where applicable, include the original and restated amounts in the presentation.

Correct Answer:

Verified

Q46: Corriveau Industries decided to switch from an

Q47: Millstone Company's first-quarter 20X3, pretax income is

Q49: Consider the following:

Case A

Income (loss) for quarters

Q51: Information about the seven segments of the

Q53: The management of Trident, Inc.is trying to

Q54: Futura Corporation reported pretax net income of

Q56: For each of the following independent cases,

Q60: Explain the difference in the independent and

Q61: Stidham Company is a large international company

Q63: For purposes of interim reporting, US-GAAP permits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents