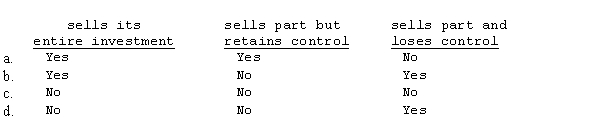

When a parent sells its subsidiary interest, a gain (loss) is recognized if the parent

Correct Answer:

Verified

When a parent sells its subsidiary int...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Which of the following statements is incorrect

Q6: Partridge purchased a 60% interest in Sparrow

Q7: When selling an investment in a subsidiary,

Q9: Pine Company purchased a 60% interest in

Q12: A parent company owns a 90% interest

Q12: If the sale of an investment in

Q15: Patten Company purchased an 80% interest in

Q16: A new subsidiary is being formed.The parent

Q16: Pine Company purchased a 60% interest in

Q19: A new subsidiary is being formed.The parent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents