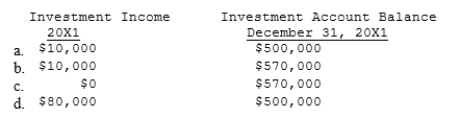

Pete purchased 100% of the common stock of the Sanburn Company on January 1, 20X1, for $500,000. On that date, the stockholders' equity of Sanburn Company was $380,000. On the purchase date, inventory of Sanburn Company, which was sold during 20X1, was understated by $20,000. Any remaining excess of cost over book value is attributable to patent with a 20-year life. The reported income and dividends paid by Sanburn Company were as follows:  Using the cost method, which of the following amounts are correct?

Using the cost method, which of the following amounts are correct?

Correct Answer:

Verified

Q11: On January 1, 20X1, Payne Corp. purchased

Q12: The method of accounting for subsidiaries that

Q13: Pete purchased 100% of the common stock

Q15: How is the portion of consolidated earnings

Q16: Alpha purchased an 80% interest in Beta

Q18: Which of the following statements applying to

Q19: The method of accounting for subsidiaries that

Q19: Pete purchased 100% of the common stock

Q20: What is the effect if an unconsolidated

Q20: On January 1, 20X1, Rabb Corp. purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents