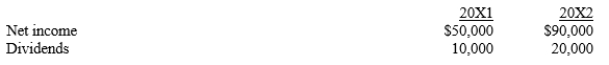

On January 1, 20X1, Parent Company purchased 80% of the common stock of Subsidiary Company for $316,000. On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $40,000, $120,000, and $190,000, respectively. Net income and dividends for 2 years for Subsidiary Company were as follows:

On January 1, 20X1, the only tangible assets of Subsidiary that were undervalued were inventory and building. Inventory, for which FIFO is used, was worth $5,000 more than cost. The inventory was sold in 20X1. Building, which was worth $15,000 more than book value, has a remaining life of 8 years, and straight-line depreciation is used. Any remaining excess is goodwill.

Prepare Parent's 20X1 and 20X2 journal entries (after the purchase has been recorded) to record the transactions related to its investment in Subsidiary under the sophisticated equity method.

Correct Answer:

Verified

Q19: Pete purchased 100% of the common stock

Q20: On January 1, 20X1, Rabb Corp. purchased

Q21: On January 1, 20X1, Parent Company purchased

Q22: On January 1, 20X1, Piston, Inc. acquired

Q23: Prossart Company owned 70% of the outstanding

Q25: On January 1, 20X1, Parent Company purchased

Q27: On January 1, 20X1, Parent Company purchased

Q28: On January 1, 20X1, Parent Company purchased

Q29: Which of the following is not true

Q34: Under IASB for small and medium entities,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents