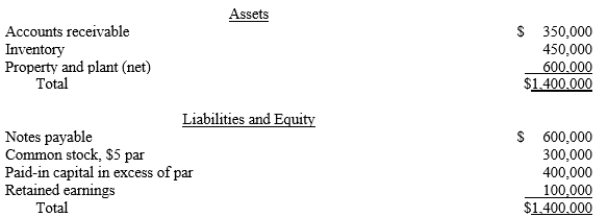

Supernova Company had the following summarized balance sheet on December 31 of the current year:

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

Assume that Redstar Corporation exchanges 75,000 of its $3 par value shares of common stock, when the fair price is $20 per share, for 100% of the common stock of Supernova Company. Redstar incurred acquisition costs of $5,000 and stock issuance costs of $5,000.

Required:

a.What journal entries will Redstar Corporation record for the investment in Supernova and issuance of stock?

b.Prepare a supporting value analysis and determination and distribution of excess schedule

c.Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

Correct Answer:

Verified

Q28: The SEC requires the use of push-down

Q29: Pesto Company paid $8 per share to

Q32: On December 31, 20X1, Parent Company purchased

Q33: Pinehollow acquired all of the outstanding stock

Q35: When a company purchases another company that

Q37: Pesto Company paid $10 per share to

Q37: Fortuna Company issued 70,000 shares of $1

Q38: Supernova Company had the following summarized balance

Q39: On January 1, 20X1, Parent Company purchased

Q40: Pinehollow acquired 80% of the outstanding stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents