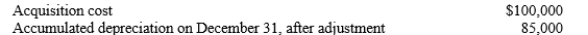

Equipment with an estimated residual value at acquisition of $15,000 was sold on December 31, for $20,000 cash. The following data were available at the time of sale:  When this transaction is recorded, it should include a

When this transaction is recorded, it should include a

A) debit of $80,000 to the Loss on Disposal account.

B) credit of $20,000 to the Equipment account.

C) credit of $5,000 to the Gain on Disposal account.

D) debit of $20,000 to the Accumulated Depreciation account.

Correct Answer:

Verified

Q66: If technology changes rapidly,a firm should

A)expense plant

Q81: Using the straight-line depreciation method will cause

Q86: Capitalizing an expenditure rather than recording it

Q87: Many companies use MACRS (Modified Accelerated Cost

Q89: Fantasy Cruise Lines

On January 1, 2019 the

Q92: A company purchased a building for $900,000

Q93: Fresh n' Fit Cuisine purchased land and

Q94: Furniture Barn and Furniture World purchased identical

Q96: Equipment with a residual value of $50,000

Q99: Using different depreciation methods for book purposes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents