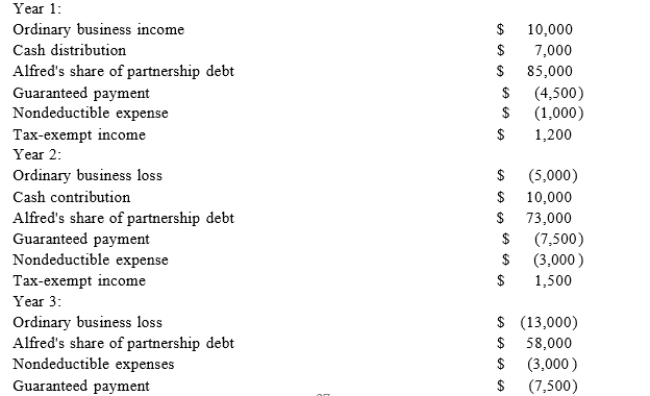

Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfredonly knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: In each of the independent scenarios below,

Q89: This year, Reggie's distributive share from Almonte

Q93: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q94: Lincoln, Inc., Washington, Inc., and Adams, Inc.

Q97: Ruby's tax basis in her partnership interest

Q100: ER General Partnership, a medical supplies business,

Q101: Fred has a 45% profits interest and

Q111: What general accounting methods may be used

Q119: Why are guaranteed payments deducted in calculating

Q123: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents