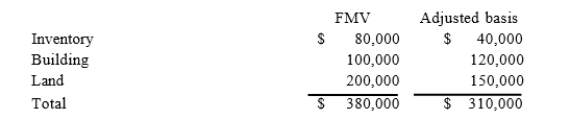

Zhao incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.  The corporation also assumed a mortgage of $50,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $330,000. The transaction met the requirements to betax-deferred under §351.a. What amount of gain or loss does Zhao realize on the transfer of the property to her corporation? b. What amount of gain or loss does Zhao recognize on the transfer of the property to her corporation? c. What is the corporation's adjusted basis in each of the assets received in the exchange?

The corporation also assumed a mortgage of $50,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $330,000. The transaction met the requirements to betax-deferred under §351.a. What amount of gain or loss does Zhao realize on the transfer of the property to her corporation? b. What amount of gain or loss does Zhao recognize on the transfer of the property to her corporation? c. What is the corporation's adjusted basis in each of the assets received in the exchange?

Correct Answer:

Verified

b. Zhao does not recogni...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q73: Jalen transferred his 10 percent interest to

Q74: Which of the following statements best describes

Q75: Katarina transferred her 10 percent interest to

Q76: Billie transferred her 20 percent interest to

Q77: Red Blossom Corporation transferred its 40 percent

Q79: Paladin Corporation transferred its 90 percent interest

Q80: Which of the following statements does not

Q82: Mike and Michelle decided to liquidate their

Q116: Jasmine transferred 100 percent of her stock

Q118: Rich and Rita propose to have their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents