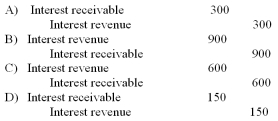

On December 1, 2010, a company loaned a new employee $20,000 to assist with her relocation expenses. The employee signed a 6-month note, with interest of 9%. The company prepares year-end financial statements at December 31. What is the required adjusting entry at December 31 as a result of this note transaction?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q102: Which of the following statements is true

Q112: What is the days to collect for

Q113: On December 1, 2010, a company accepted

Q114: What is the total amount of interest

Q115: The required entry(ies) on May 29 to

Q116: Assuming the entry to record bad debt

Q118: If the company changes its credit granting

Q120: A company uses the percentage of credit

Q121: What is the amount of current assets

Q122: What was the amount of cash collections

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents