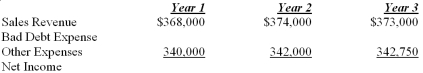

The Dubious Company operates in an industry where all sales are made on account. Historically, Dubious has experienced a steady 1.0% of credit sales being uncollectible. Presented below is the company's forecast of sales and expenses over the next three years.  Using this information:

Using this information:

a. Calculate bad debt expense and net income for each of the three years, assuming uncollectible accounts are

estimated as 1.0% of sales.

b. Comment on the trend in net income changes from Year 1 to Year 2 and from Year 2 to Year 3.

c. Suppose the company changes its estimate of uncollectible credit sales to 1.0% in year 1, 2.0% in year 2 and

1.5% in year 3. Calculate the bad debt expense and net income for each of the three years under this alternative

scenario.

d. Comment on the trend in net income changes determined in requirement c from Year 1 to Year 2 and Year 2

to Year 3.

e. Under which scenario (a or c) do you feel most confident when predicting the net income likely to be earned in Year 4? What contributes to this feeling?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: What is the amount of current assets

Q122: What was the amount of cash collections

Q123: Purrfect Pets, Inc., had sales revenue of

Q124: A company used the aging of accounts

Q125: Adventure Company uses the aging of accounts

Q127: For each of the following transactions, indicate

Q128: For each scenario below, indicate the appropriate

Q129: The allowance method for estimating bad debts

Q131: What is the amount of Bad Debt

Q215: The direct write-off method:

A)results in better matching

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents