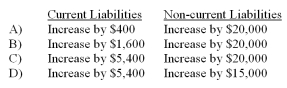

At the beginning of the quarter, your company borrows $20,000 by signing a four-year promissory note that states an annual interest rate of 8% plus principal repayments of $5,000 each year. Interest is paid at the end of the second and fourth quarters, whereas principal payments are due at the end of each year. How does this new promissory note affect the current and non-current liability amounts reported on the balance sheet at the end of the first quarter?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q21: A company receives $95 for merchandise sold

Q40: The threshold for recording contingent liabilities under

Q42: What adjusting entry should Backyard make on

Q43: During one pay period, your company distributes

Q47: A corporate bond with a face value

Q48: On January 1, which of the following

Q49: A company typically records the amount owed

Q57: IBM is planning to issue $1,000 bonds

Q59: IBM is planning to issue $1,000 bonds

Q105: If the market rate of interest is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents