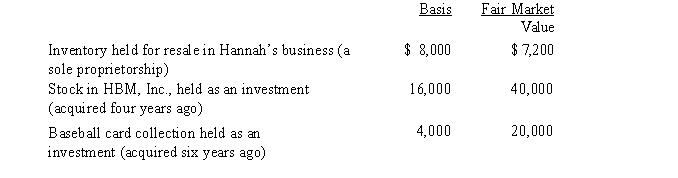

Hannah makes the following charitable donations in the current year:  The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

A) $28,000.

B) $51,200.

C) $52,000.

D) $67,200.

E) None of the above.

Correct Answer:

Verified

Q49: This year, Carol, a single taxpayer, purchased

Q50: Roger is considering making a $6,000 investment

Q58: Ahmad is considering making a $10,000 investment

Q63: Byron owned stock in Blossom Corporation that

Q70: Your friend Scotty informs you that he

Q72: In the current year, Jerry pays $8,000

Q110: During the current year, Ralph made the

Q111: Hugh, a self-employed individual, paid the following

Q112: In 2017, Juan and Juanita incur $9,800

Q114: Paul, a calendar year single taxpayer, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents