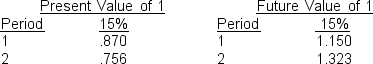

Peanut Co.is planning on investing in a new 2-year project, Project Jelly.Project Jelly is expected to produce cash flows of $100,000 and $120,000 in year 1 and year 2, respectively.Peanut requires an internal rate of return of 15%.What is the maximum amount that Peanut should invest immediately in Project Jelly?

A) $191.400

B) $177,720

C) $220,000

D) $273,760

Correct Answer:

Verified

Q45: The profitability index is calculated by dividing

Q46: The following information is available for

Q47: The major difference between the net present

Q53: Which of the following statements is false?

A)By

Q83: Intangible benefits in capital budgeting

A) should be

Q84: In evaluating high-tech projects,

A) only tangible benefits

Q86: Intangible benefits in capital budgeting would include

Q87: If a company's required rate of return

Q92: An approach that uses a number of

Q97: The profitability index

A) does not take into

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents