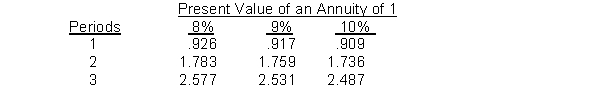

Use the following table for questions .

-A company has a minimum required rate of return of 8% and is considering investing in a project that costs $67,145 and is expected to generate cash inflows of $27,000 each year for three years.The approximate internal rate of return on this project is

A) 8%.

B) 10%.

C) 9%.

D) less than the required 8%.

Correct Answer:

Verified

Q27: Doris Co.is considering purchasing a new machine

Q64: A capital budgeting method that takes into

Q73: When accepting large capital projects, a company

Q75: Use the following information for questions

A

Q78: Use the following information for questions

A

Q83: Peanut Co.is planning on investing in a

Q84: An intangible benefit of a project would

Q118: The internal rate of return is the

Q137: The capital budgeting technique that finds the

Q151: The annual rate of return method is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents