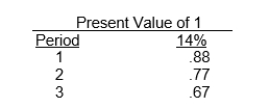

Vault Company wants to purchase an asset with a 3-year useful life, which is expected to produce cash inflows of $10,000 each year for two years, and $15,000 in year 3.Vault has a 14% cost of capital, and uses the following factors.What is the present value of these future cash flows?

A) $30,800

B) $30,400

C) $26,550

D) $34,750

Correct Answer:

Verified

Q23: Capital budgeting relies on cash inflows and

Q25: The cash payback method is useful because

A)it

Q31: When evaluating a project, companies should always

Q36: Mystery Co.is considering purchasing a new piece

Q89: Use the following information for questions

A

Q90: In using the Internal Rate of Return

Q90: Cleaners, Inc.is considering purchasing equipment costing $30,000

Q95: Cleaners, Inc.is considering purchasing equipment costing $30,000

Q97: Tammy Co.is considering purchasing a machine that

Q98: Cleaners, Inc.is considering purchasing equipment costing $30,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents