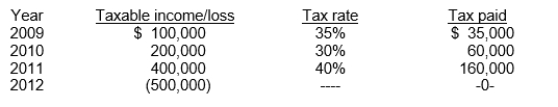

Georgia, Inc.has no temporary or permanent differences.The company experiences the following:

In 2012, Georgia, Inc.decides to carry back its NOL.What amount of income tax refund receivable will Georgia record for 2012?

A) $200,000

B) $180,000

C) $190,000

D) $ -0-

Correct Answer:

Verified

Q78: Use the following information for questions.

Lyons Company

Q79: Use the following information for questions.

Mitchell Corporation

Q80: Use the following information for questions.

Kraft Company

Q81: Palmer Co.had a deferred tax liability balance

Q82: Use the following information for questions.

Wilcox Corporation

Q84: A reconciliation of Gentry Company's pretax accounting

Q85: Use the following information for questions.

Operating income

Q86: Use the following information for questions.

Operating income

Q87: Rodd Co.reports a taxable and pretax financial

Q88: Lincoln Company has the following four deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents