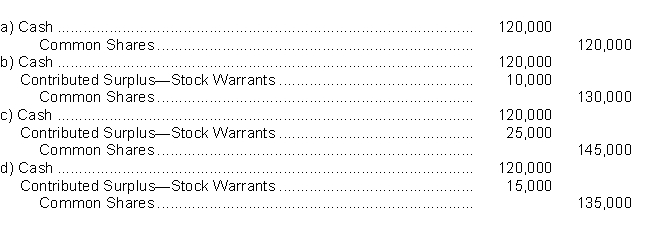

On July 1, 2017, Juba Inc.issued 10,000, $7 non-cumulative, no par value preferred shares for $1,050,000.Attached to each share was one detachable warrant, giving the holder the right to purchase one of Juba's no par value common shares for $30.At this time, the shares without the warrants would normally sell for $1,025,000, while the market price of the warrants was $2.50 each.On October 31, 2017, when the market price of the common shares was $19 and the market value of the warrants was $3.00, 4,000 warrants were exercised.Juba adheres to IFRS.As a result of the exercise of the warrants and the issuance of the related common shares, what journal entry would Juba make?

Correct Answer:

Verified

Q58: Dakar Inc.has $3,000,000 (par value), 8% convertible

Q59: Use the following information for questions.

On April

Q60: Use the following information for questions.

On August

Q61: Use the following information for questions.

On January

Q63: On March 1, 2017, Rabat Corp.sold $300,000

Q64: Use the following information for questions.

On May

Q65: On December 31, 2015, in order to

Q66: On December 1, 2017, Cairo Ltd.issued 500

Q67: On April 7, 2017, Soweto Corp.sold a

Q80: The date on which to measure the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents