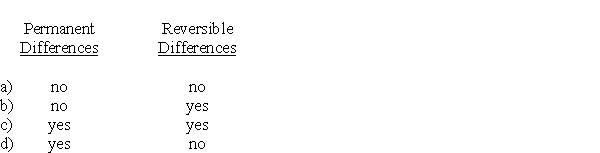

When calculating income tax expense, taxable income of a corporation differs from pre-tax accounting income because of

Correct Answer:

Verified

Q8: For calculating income tax expense, IFRS requires

Q13: Alabama Corp.'s taxable income differed from its

Q14: The difference between the tax base of

Q15: For calculating income tax expense, ASPE allows

Q18: Machinery was acquired at the beginning of

Q20: Of the various taxation options available to

Q20: The tax base of a liability is

Q21: At the end of 2017, its first

Q28: A deferred tax asset is the

A) current

Q40: A deferred tax liability is the

A) current

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents