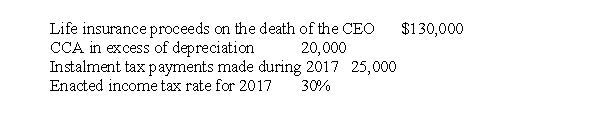

Bare Fashions Corp. reported pre-tax accounting income of $300,000 for calendar 2017. To calculate the income tax liability, the following data were considered:  What amount should Bare Fashion report as its current income tax liability on its December 31, 2017 statement of financial position?

What amount should Bare Fashion report as its current income tax liability on its December 31, 2017 statement of financial position?

A) $20,000

B) $26,000

C) $45,000

D) $51,000

Correct Answer:

Verified

Q36: Under IFRS, how are deferred tax asset

Q37: McMurray Inc. incurred an accounting and taxable

Q39: Shierling Corp. reported pre-tax accounting income of

Q41: Allocating income tax expense or benefit for

Q41: A reconciliation of Quebec Corp.'s pre-tax accounting

Q42: At the end of 2017, its first

Q43: At the end of 2017, its first

Q44: Saucy Inc. reported a taxable and accounting

Q45: In 2017, Savoury Ltd. accrued, for book

Q60: Recognizing a deferred tax asset for most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents