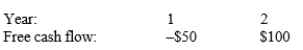

Leak Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 11% and FCF is expected to grow at a rate of 5% after Year 2, what is the Year 0 value of operations, in millions? Assume that the ROIC is expected to remain constant in Year 2 and beyond (and do not make any half-year adjustments) .

A) $1,456

B) $1,529

C) $1,606

D) $1,686

Correct Answer:

Verified

Q4: Simonyan Inc.forecasts a free cash flow of

Q8: If a company's expected return on invested

Q13: Two most important issues in corporate governance

Q14: Akyol Corporation is undergoing a restructuring, and

Q14: Value-based management focuses on sales growth, profitability,

Q16: The corporate valuation model cannot be used

Q17: A company forecasts the free cash

Q18: Zhdanov Inc.forecasts that its free cash flow

Q19: Suppose Yon Sun Corporation's free cash flow

Q20: Which of the following statements is NOT

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents