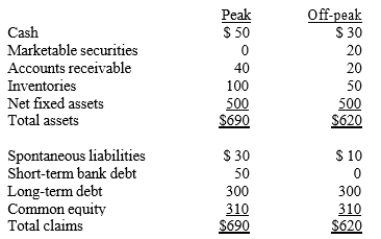

Ski Lifts Inc. is in a highly seasonal business, and the following summary balance sheet data show its assets and liabilities at peak and off-peak seasons (in thousands of dollars) :  What can we conclude from this data?

What can we conclude from this data?

A) Ski Lifts's working capital financing policy calls for exactly matching asset and liability maturities.

B) Ski Lifts's working capital financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt.

C) Ski Lifts follows a relatively conservative approach to working capital financing; that is, some of its short-term needs are met by permanent capital.

D) Without income statement data, we cannot determine the aggressiveness or conservatism of the company's working capital financing policy.

Correct Answer:

Verified

Q54: The factoring of receivables involves the specific

Q55: The cost of an installment loan is

Q57: Firms must have high credit quality in

Q60: Discount loans are usually provided for terms

Q67: Which of the following statements best describes

Q68: Which of the following statements best describes

Q72: Helena Furnishings wants to reduce its cash

Q73: Which of the following borrowers benefit the

Q76: Which of the following statements is most

Q77: The blanket inventory lien gives the lender

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents