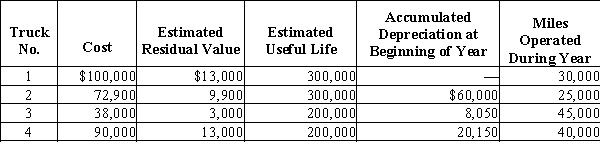

Prior to adjustment at the end of the year, the balance in Trucks is $300,900 and the balance in Accumulated Depreciation-Trucks is $88,200. Details of the subsidiary ledger are as follows:??  Required

Required

(a)Based on the units-of-activity method, determine the depreciation rates per mile and the amount to be credited to the Accumulated depreciation section of each of the subsidiary accounts for the miles operated during the current year.

(b)Journalize the entry to record depreciation for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q188: Comment on the validity of the following

Q189: A machine costing $185,000 with a five-year

Q190: On July 1, Harding Construction purchases a

Q191: Computer equipment was acquired at the beginning

Q192: Convert each of the following estimates of

Q194: For each of the following fixed assets,

Q195: A machine costing $57,000 with a six-year

Q196: Equipment purchased at the beginning of the

Q197: Determine the depreciation for the year of

Q198: On July 1, Hartford Construction purchases a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents