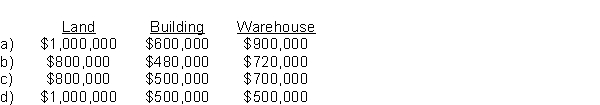

Mertle Holdings Co. purchased 12 acres of land with an office building and warehouse on it for $2,000,000. The assets were appraised at: land $1,000,000, building $600,000, and warehouse $900,000. The assets were carried on the seller's books at: land $800,000, building $500,000, and warehouse $700,000. At what cost should the purchasing company record each of the assets?

Correct Answer:

Verified

Q1: The cash inflows generated from a long-term

Q1: The unexpensed portion of an depreciable asset

Q4: Which of the following would NOT be

Q4: Under ASPE,property,plant,and equipment must be recognized using

Q5: A plot of land was purchased for

Q8: In 2017 as part of a property

Q9: Which of the following would NOT be

Q10: Ukela Corp. purchased a piece of equipment

Q11: The depreciable cost of an asset is

Q39: The ultimate sales value of a long-term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents