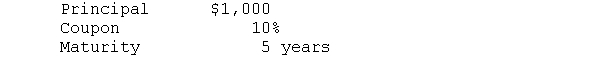

Junk Corp.'s high?yield bond has the following features:

Special features: Company may extend the life

of the bond to 10 years

a. If interest rates are currently 12 percent on comparable high-yield securities and are not expected to change, what is the price of this bond?

b. If interest rates are currently 9 percent on comparable high?yield securities and are not expected to change, what is the price of this bond?

c. If interest rates are currently 9 percent on comparable high?yield securities but the investor has no forecast as to future rates, what is the possible range of prices for this bond?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: The current yield on a long-term bond

Q42: The concept of duration considers

A)the timing of

Q45: Preferred stock and long-term bonds are similar

Q54: A bond has the following terms:

Q55: A high-yield bond has the following terms:

Q56: If interest rates rise, the price of

Q59: Compute the durations of the following bonds

Q61: You purchase a high-yield, junk bond for

Q63: An investor buys a $1,000, 20 year

Q63: If you purchase a $5 preferred stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents