Kate Bell was employed by The Tea Shop Ltd. (a Canadian controlled private corporation) from January to December of 20x4. She earned a gross salary of $72,000.

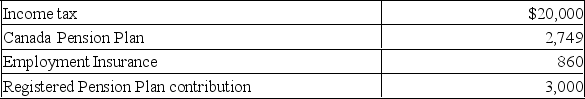

The following were deducted from her pay during the year:

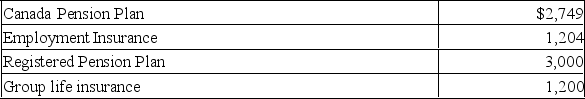

The following amounts were paid by The Tea Shop Ltd. in 20x4 on Kate's behalf:

The following amounts were paid by The Tea Shop Ltd. in 20x4 on Kate's behalf:

Additional information:

Additional information:

On January 15, 20x2, Kate was given an option to purchase 500 shares of The Tea Shop for $5.00 per share. The market value of the shares on that date was $5.50. Kate exercised her option on June 1, 20x3 when the shares were valued at $7.00. She then sold the shares on March 17, 20x4 when the market value was $8.00 per share.

Kate pays $50 a month for her cell phone which she uses to keep in touch with friends and family. She also pays $80 a month to dry-clean her suits, and she purchases a new suit valued at $200 every three months. Kate purchased $300 worth of merchandise (at cost) from her employer during the year. The retail value of the merchandise was $500.

Kate contributed $1,000 to her RRSP during the year.

Required:

A) Calculate Kate's minimum net income for tax purposes for 20x4, in accordance with Section 3 of the Income Tax Act. Identify items that have been omitted in your calculations. (Kate minimizes her tax liability whenever possible.)

B) Will Kate be able to deduct the stock option deduction to arrive at her taxable income? Why or why not?

Correct Answer:

Verified

Q2: Which of the following factors are used

Q2: An individual has the option to receive

Q3: Andy worked for High Speed Bikes Inc.

Q3: Which of the following, when provided by

Q4: Sarah borrowed $25,000 from her employer at

Q4: Susan was provided with a company car

Q5: Cindy works for Sky Manufacturers Ltd., which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents