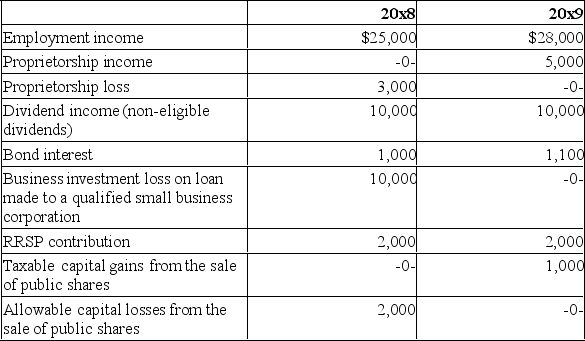

Susan White incurred the following income, disbursements, and losses in 20x8 and 20x9:

Additional information:

Additional information:

20x7 was the first year that Susan sold a capital asset.

Susan incurred a business loss of $5,000 from her proprietorship in 20x7 (the first year of the business) that was not needed to reduce her net income for tax purposes in 20x7.

She has never used her lifetime capital gains deduction.

Required:

Calculate Susan's minimum taxable income for 20x8 and 20x9, in accordance with Section 3 of the Income Tax Act. (Assume 20x7, 20x8, and 20x9 are 2017, 2018, and 2019.)

Correct Answer:

Verified

Q1: ABC. Ltd. had an unused allowable capital

Q2: Which of the following accurately describes a

Q3: Archie Smith works full-time as a dentist

Q4: Theodore is 37 years old. He earned

Q5: Which of the following is FALSE with

Q6: Samantha received an eligible dividend in the

Q7: Stuart Planter is a full-time teacher, and

Q9: Which of the following is not one

Q10: Sally earned $210,000 during 20x8. CPP and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents