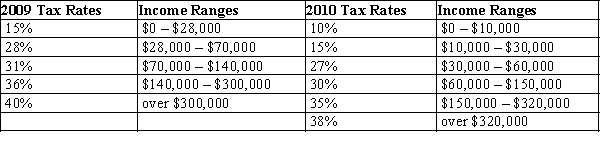

Table 12-18

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-18. What type of tax structure did the United States have in 2009 for single individuals?

A) a proportional tax structure

B) a regressive tax structure

C) a progressive tax structure

D) a lump-sum tax structure

Correct Answer:

Verified

Q103: In which of the following tax systems

Q147: Table 12-20

The following table presents the total

Q148: Table 12-20

The following table presents the total

Q149: Table 12-16 Q150: Table 12-16 Q151: Table 12-21 Q153: Table 12-17 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

The dollar amounts in the last

The following table shows the marginal