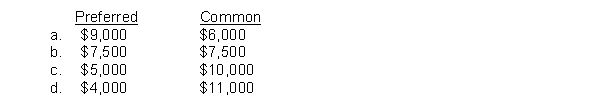

Lopez, Inc. has 2,000 shares of 4%, $50 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2009, and December 31, 2010. The board of directors declared and paid a $3,000 dividend in 2009. In 2010, $15,000 of dividends are declared and paid. What are the dividends received by the preferred and common shareholders in 2010?

Correct Answer:

Verified

Q41: Indicate the respective effects of the declaration

Q43: Manner, Inc. has 5,000 shares of 5%,

Q44: If a stockholder receives a dividend that

Q46: On the dividend record date

A) a dividend

Q51: Which of the following is not a

Q52: Which of the following statements about dividends

Q55: Which of the following statements regarding the

Q57: The cumulative effect of the declaration and

Q88: The declaration and distribution of a stock

Q95: Which one of the following events would

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents